What is paper money?

To start with let’s look at the definition of paper money and the reason why it was originally introduced. Paper money is circulated by a country to allow its citizens to engage in transactions by using it. It is regulated mostly by the central bank of the country to ensure that cash flow is in tandem with the monetary policies.

Why did it originate?

China introduced paper money in the 7th century A.D as dealing with heavy and numerous metallic coins was getting too difficult. Traders would deposit their coins to a trustworthy party and then receive a note stating the amount of deposited money. This note can be then redeemed for money at a different time or place.

Does number of notes issued by a country depend on the reserves?

As per history of paper money like mentioned in the earlier answer, a bill is issued against the money that was deposited. Even then, the answer to this particular question is no. There is a common misconception that the country has to have gold reserves worth the money they are going to print. This is not true; the country is free to print as many notes as they want.

When does a country overprint money?

In times of recession, or economic crisis, governments overprint currency notes. This is also known as Quantitative Easing. But there is a problem attached with this solution. Excess printing will lead to inflation and in some cases hyper-inflation too.

How can printing more money lead to inflation?

The answer to this question lies in the relation between demand-price and supply-price. Generally price and demand is almost inversely proportional. If there is a high demand, prices of commodities reduce and if there is a low demand, prices increase. The case is reverse while considering the relationship between supply and price. When the prices increase, more suppliers would want to venture into the business and hence the supply will also increase. The price of a commodity is defined by its demand and supply.

So back to the same question again! How can printing more money lead to inflation?

When someone’s wallet is full of money there is a tendency to spend more as well. Suppose you have 50 rupees in your purse, you would plan your day in such a way that you only travel using public transport, but if you had a 500 Rs note, you would also consider taking a taxi or two. Now if you keep doing it for many days, you will get used to taking the taxi. For 1 rupee you will try asking more than how much it can actually fetch you. To control this buying and spending tendency, prices will have to be increased and hence inflation shoots up.

Take the case if Zimbabwe, inflation shot up so much that 3 eggs would cost you 100 billion Zimbabwean Dollars. But a 100 billion Zimbabwean Dollars is only worth 15 U.S Dollars!

Now you know why printing money is no child’s play. Supply, Demand, Prices, Inflation and recession factors need to be considered while deciding on the number of paper money that needs to be printed during a particular time. You wouldn’t want inflation to rise and 3 eggs to cost you 100 billion rupees!

-

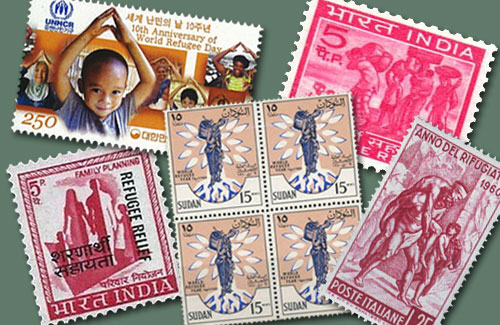

Stamps on International Refugee Day

Violence, wars, terrorist attacks and prosecutions have torn the world apart into pieces t...

-

Young Philatelist: Mythical Creatures on Stamps

Can you imagine a world without stories? We were all born to tell and listen to them; that...

-

Young Numismatist: Time to Show You The Money

You always cribbed “Show Me the Money”. Now you get to see me in person, nice, up and ...

-

Types of Fancy Number Currency Notes

Types of Fancy Number Currency Notes Many notes come and go from your pockets and wallets...

-

Essential Tools for Every Stamp Collector

Gearing up the right way for anything that you have set your minds on always comes in hand...

-

Celebrating Buddha Purnima Through Coinage

21st May will be observed as Buddha Purnima this year across the country, celebrating the ...

-

Why Can't a Country Choose to Get Richer By Printing More Paper Money?

A question that many of us might have thought of, but never knew whom to ask. Today, let�...

-

Remembering Rabindranath Tagore

7th May 1861 was a special day in Indian history indeed. Rabindranath Tagore, one of the w...

-

CM Devendra Fadnavis Launches Mintage World

23rd April 2016 was a very special and eventful day indeed! Mintageworld.com was officiall...

-

8 Tips for Budding Stamp Collectors

Collecting stamps is more than just a hobby for some. It’s an experience that helps you ...